Encumbrance Certificate in Property Buying and selling- Application Form, Form 15 16, Format

Aadil Saif 14 September 2019

Certificate of Encumbrance on Property

An encumbrance certificate is a crucial document when it comes to the sale and purchase of a property, and in this article, we will explain more about it. The word “encumbrance” when referring to a property, is about the liabilities that exist on it. An encumbrance certificate is valid for a particular requested period, and it is a note of the registered transactions related to the property for that specific period. An encumbrance certificate is available from the office of the sub-registrar, at which the property registration was done. It is certified that as an assurance that the property to be sold or purchased, is free from any monetary or legal liability,

Encumbrance Certificate

The encumbrance certificate (EC) is a required and necessary document. It is used as evidence of a title that is free or total ownership in property transactions. When you purchase a flat, house, or plot, it is very important that you verify that the property does not have any legal or financial dues. An EC certificate makes sure that there is total ownership of the property, without any kind of liability – legal or monetary.

Importance of Encumbrance Certificate for Buying and selling a Property?

The encumbrance certificate is an important document for those of you who are applying for a home loan or you want to get a loan against property, or you want to purchase or sell a property. Encumbrance refers to the liabilities created on a property. The EC certificate is taken as security for any of the owner’s debts, which is yet to be discharged as on the date. The EC document lists all the transactions registered that are related to the property in question, for a specific period, as requested. The details also contain any encumbrance or claims on the property.

Financial institutions like banks and government authorities typically demand 10 to 15 years of encumbrance. However, if you want, you can request for an encumbrance certificate for up to 30 years to be checked. If you still have doubts, you can obtain a Possession Certificate for ownership of the particular land, which you can get from the village office.

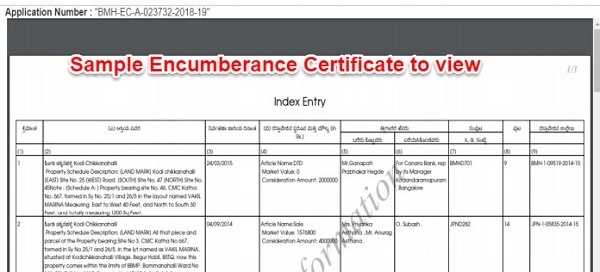

form 15 and 16 Encumbrance Certificate Format

The encumbrance certificate is issued as Form number 15 and Form number 16. If there is no encumbrance on the property for the specific period asked for, then a Form 16 is issued, which is a certificate of Nil-Encumbrance. If there is any encumbrance registered during the requested period, then Form 15 is issued. The certificate that is given in Form 15 displays the documents that are registered for the property, the type of encumbrance, like partition, lease, mortgage, gift, the involved parties, the registered number of the document and other details sorted by date.

Remember that if you are asking for an encumbrance certificate for a specific period, you will receive details for only that period, and nothing more. These details are given from the entries that are in the registrar that the sub-registrar has.

How do you get an encumbrance certificate?

The encumbrance certificate can get from the sub-registrar's office where the registered property in reference. To obtain an encumbrance certificate, An application is to be made to the registrar for obtaining the certificate in Form 22.

To obtain an encumbrance certificate, follow the steps as given below:

- Download or obtain Form 22 from the sub-registrar’s office. Fix a revenue stamp worth Rs. 2 to it, and make the Tahsildar the addressee, along with a copy of your residential address (duly attested), and the reason why you need the certificate.

- Give the details of ownership like the correct survey number and the location where the property is situated. Remember that it is important that you mention the period and complete description of the property in the application.

- Pay the necessary fees, which usually begins from Rs. 100 and goes up depending on the number of years for which you need the EC patta. The fees is decided based on the period of encumbrance requested for. An encumbrance year begins from 1st April of a calendar and ends on 31st March, of the next calendar year. The fees is different depending on the state where you live and state rules and regulations. Also, the encumbrance certificate is usually in the regional language. You can obtain an EC copy that is translated in English for an additional fee.

- Submit the application to the sub-registrar’s office of your property’s jurisdiction.

- Once you submit the application, an inspector will check all the transactions that took place against the property for the requested period.

- Once the inspection is complete, the sub-registrar will issue the EC certificate as either Form 15 or Form 16, as the case may be.

![]()

Time Duration for an EC Application

It usually takes 15 to 30 working days time period to obtain an encumbrance certificate. You should also note that while an EC document provides the details of the encumbrance existing on a property, there are some documents that have exemption from being registered at the sub-registrar’s office. The details of these documents will not be available in the encumbrance certificate. Therefore, we recommend that you, the buyer, try and obtain both the encumbrance certificate and the possession certificate which will prove total property ownership.

If you are interested in buying a property, the ideal scenario is to get both the EC certificate and the possession certificate, so that you do not face any issues later and you can buy the property without any hassle.

Get in Touch With us

Register here and Avail the Best Offers!!