Latest Updates about Real Estate Sector

Addressofchoice 12 November 2016

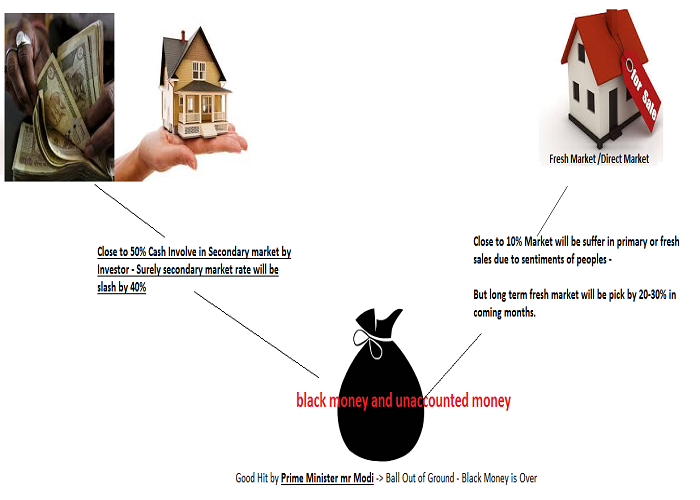

With the government scrapping Rs. 500 and Rs.1,000 notes, cash hoarders are diverting large sums into acquisition of land in several States by making payments to owners of small parcels of land. The Securities and Exchange Board of India and the Reserve Bank of India also play a role in the regulation. Also, as per Income Tax rules, real estate agencies are required to inform the authorities about transactions over Rs. 30 lakh.

According to government estimates, the real estate sector makes for seven per cent of the country’s GDP. It grew in billion between 2005 and 2016 and is expected to go up to billion by 2020. Financial investigating agencies are preparing a comprehensive report on the vulnerabilities in the real estate sector in terms of money laundering operations. particularly agriculturists.The Centre has already come up with certain regulations and laws to keep a close watch on the sector, particularly in the use of cash. Experts believe that after the demonetisation of the Rs. 500 and Rs. 1,000 notes, investigating agencies would focus on the stringent implementation.

The Real Estate Regulatory Authority is also understood to be preparing to implement a licensing regime for better regulation of the sector. The Financial Intelligence Unit, under the Prevention of Money Laundering Act, is empowered to keep track of the real estate transactions, whereas the Registrar of Properties keeps ownership and transfer records.

Agencies suspect that a significant portion of the unaccounted Rs. 500 and Rs. 1,000 notes are being used to make advance payments for gold at rates much higher than the official price. What the cash hoarders would get in return later is unaccounted or smuggled gold. This apart, the government’s focus is also on the precious gems sector, where the Gems and Jewellery Export Promotion Council has already played a key role in helping investigating agencies track cases of round-tripping.

Get in Touch With us

Register here and Avail the Best Offers!!