Nagpur Property Tax Payment, Online Guide, Municipal Corporation

Aadil Saif 08 January 2021

Nagpur Property Tax Online Payment

With Nagpur Property Tax Online Payment gaining momentum, the work of the taxpayers and the Municipal Corporation has become simplified and transparent. Not only this, the online method has led to an increase in the tax collection amount because people prefer to pay the tax with the swipe of the finger instead of facing the ordeal of standing in the office of the Nagpur Municipal Corporation (NMC). Paying property tax on residential and commercial buildings (with a few exceptions like heritage land, property used for religious purposes, cremation, or burial grounds) is the responsibility of the citizens and with the amount so collected the administration carries on the work of the development of the city.

View Your Property Tax Demand Online

http://114.79.182.178:9180/ptis/citizen/search/search!searchForm.action

Check Your Last Tax Receipt Online

https://www.nmcnagpur.gov.in/check-your-last-tax-receipt

How does NMC Calculate Property Tax?

NMC imposes the property tax on a rateable-value-based tax system which is calculated on the Annual Letting Value of the property. The factors like property usage, occupancy type, net built-up area, age of the property, and structural details are the determinants while arriving at the property tax amount. The work of collecting the property tax rests on the Property Tax Department of NMC and the officials here first calculate the monthly rent and based on the amount so arrived, the annual rent of the property is calculated which is 10% on the letting value of the property. Nagpur is divided into 6 blocks and ready reckoner rates of the property are the underlying factor behind this division and thus, the property tax amount is arrived at in the following way:

Properties with a ready reckoner (RR) rate of Rs 50,000 and above are in Block 1 and the value is Rs 11. In the case of properties with an RR rate between Rs 40,000-Rs 50,000, the value is Rs 10 and such properties are in Block 2. Properties having RR rate between Rs 30,000-Rs 40,000 are in Block 3 and the value is Rs 9. Properties with RR rate between Rs 20,000-Rs 30,000 have a value of Rs 8 and are in Block 4. Properties with RR rate between Rs 10,000-Rs 20,000 are in Block 5 with a value of Rs 7. And the properties below Rs 10,000 are in Bock 6 with a value of Rs 6.

Structure of the property is the next factor which has segregation as:

- Premium quality: 1.25

- Good quality: 1

- Average quality: 0.80

- Low quality: 0.50

- Usage factor is segregated as

- Commercial: 2.5

- Unspecified: 2

- Residential: 1

Age of the properties is another determinant and is divided as:

- 0-10 years: 1

- 11-20 years: 0.95

- 21-30 years: 0.90

- 31-40 years: 0.85

- 41-50 years: 80

- 51-60 years: 0.75

- Above 60 years: 0.70

Commercial properties that are registered with NMC are restaurants, bars, airports, shopping malls, multiplexes, hospitals, shops, lodges, and petrol pumps. Residential properties included under the ambit of property tax calculation are open plots, education institutes, sports grounds, residential complexes, advocates chambers, and trust hospitals.

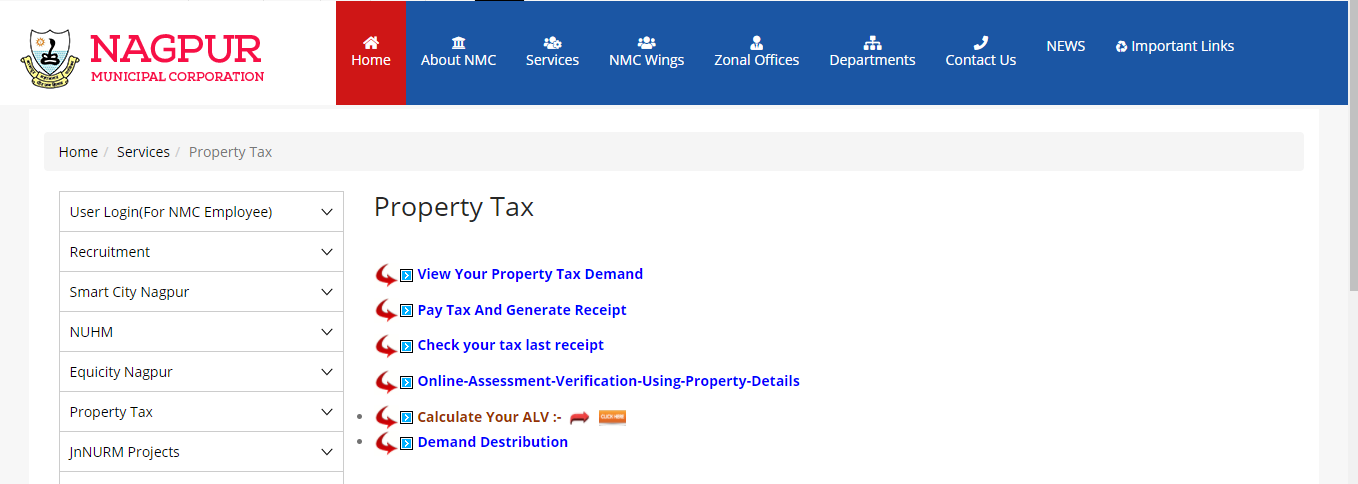

How to Make Nagpur Online Property Tax Payment?

- Logon to the official website of Nagpur Municipal Corporation

- Click on “View your property tax demand” and punch in the index number of your property.

- Choose the payment method which can be net banking or debit/credit card and once you are through with this a receipt will be generated which is the record of the payment made.

Paying property tax is the responsibility of the owner and online payment has made this task secure and fast.

Get in Touch With us

Register here and Avail the Best Offers!!