Rent Receipt Online With Revenue Stamp & House Rent Receipt

Aadil Saif 19 April 2021

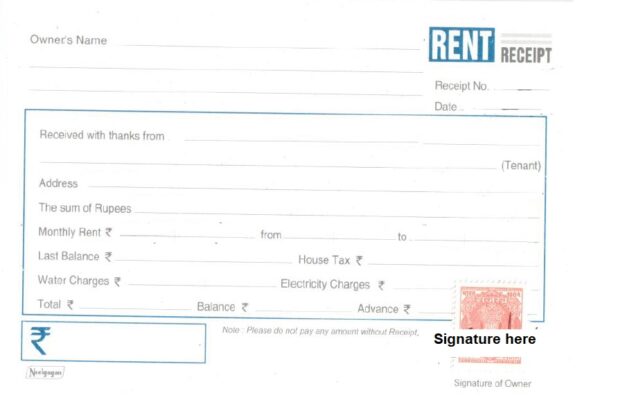

Rent Receipt Online with Revenue Stamp

Do you stay in rented accommodation? If yes, then rent receipt must have been a much-heard term, and if not, then we will understand the term in this article.

What is a rent receipt?

A rent receipt is the acknowledgement of the payment made by you of the rent paid every month to the landlord. The landlord issues this receipt once the rent is collected, and one can use this receipt for any legal purpose. (if the situation demands).

What are the Valid Elements of the Rent Receipt?

- Name of the tenant

- Name of the landlord

- Amount of rent

- Date of payment

- Address of the rented property

- Period of rent

- Signature of the landlord or anyone who has been authorized on his/her behalf to sign the receipt

- PAN of the landlord is required if the annual rent is more than Rs 1 lakh a year

- Revenue stamp is to be affixed if the amount paid in cash exceeds Rs 5000

Are Rent Receipts Issued Monthly?

Though the rent receipt need not be issued monthly, it is advisable to do so for Income Tax purpose. If not monthly, you can do it quarterly, bi-annually or annually.

Why is Rent Receipt Required?

Don’t you want any evidence of the payment that you have made to the landlord? A rent receipt is thus the proof that the payment has been made and in addition to this, if you have to claim HRA (House Rent Allowance) every month from your employer, submitting rent receipt and the rent agreement is mandatory. It is based on the rent receipt that the HRA is calculated.

HRA is provided to the employees to meet the cost of living in rented accommodation. HRA is the biggest tax saving avenue because the total HRA is not taxable; the least of the following 3 is exempted:

- Actual HRA received

- Rent paid-10% of salary

- 40% of salary (In cities like Mumbai, Delhi, Chennai and Kolkata, the figure is 50%)

Thus rent receipts act as proof that the rent payment has truly been paid, and you are not taking the benefit of fake expense to escape the tax liability.

Is Rent Receipt Required for HRA Purpose?

- When the employee receives HRA, which is more than Rs 3000 per month, then providing rent receipt to the employer is mandatory.

- If HRA received is less than Rs 3000 per month, it is not mandatory, but keeping the rent receipt is of no harm.

What are the Documents Required to Claim HRA?

- Rent receipts

- Rent agreement

- PAN no of the landlord if rent exceeds Rs 1 lakh in a year

For claiming an exemption in Form-16 and avoid Income Tax hassles, rent receipts must be furnished timely.

Who is entitled to Claim HRA Exemption?

HRA exemption can be claimed if:

- You are a salaried person

- You have accepted HRA as part of your CTC

- You live in rented accommodation

Can Home Loan Deduction and HRA be Claimed Simultaneously?

You can claim both deductions to reduce your tax liability.

Why Should Rent Receipt be submitted to the HR Department?

HR departments have resorted to taking rent receipts so that no one submits fake tax receipts to avoid tax liability.

What are the important points to be checked in a rent agreement?

- A rent agreement can be entered into for 11 months.

- The agreement must be on Rs 500 stamp paper or the stamp rate of the state where you are living.

- In case you live in the rented accommodation for more than 12 months, then the lease deed has to be registered.

- The rent agreement is renewed after every 11 months with a subsequent increase in the rent.

- The tenant and the landlord have to serve the notice period, as mentioned in the agreement.

What are the important points worth being considered in rent receipts?

- If the amount of rent paid in cash is more than Rs 5000, then the revenue stamp has to be affixed on the receipt. If the payment is made by cheque revenge, a receipt is not required.

- You are required to submit the revenue receipts for the months for which you have claimed HRA.

- In case the amount of rent paid to the landlord is more than Rs 100000 in a year, then the PAN number of the landlord has to be furnished along with the receipt. In case the landlord refuses to submit the PAN number, then you will not be entitled to claim HRA, which is over Rs 100000. TDS on the remaining amount will be deducted accordingly.

How can rent payment help in tax saving?

The following three situations are possible:

- If HRA is a part of the CTC and a copy of the rent payment is submitted to HR.

Example:

- Actual HRA: Rs 2, 40, 000

- Rent paid -10% Basic salary (Rs 1, 90, 000- Rs 70, 000 (10% of Rs 7, 00, 000) = Rs 1, 20, 000

- 50% of basic salary (50% of Rs 7, 00, 000) = Rs 3, 50, 000

The lowest of the three figures will be selected as exempted HRA. In this case it is Rs 1, 20, 000.

- If HRA is a part of your CTC but you have forgotten to submit the necessary proof documents of rent payment

In this case, you can claim HRA tax benefit but you will have to incur the notional loss which will be the excess amount of TDS deducted during the specified financial year.

- In case HRA is not a part of your CTC

You can claim the deduction up to Rs 60,000 under section 80GG at the time of filing the return.

Can HRA be claimed if rent is paid to the parents?

This is possible only if you enter into a valid rent agreement with the parents and rent receipts are furnished as per norms. The parents will have to show income received from rent when they fie the ITR.

Can a husband and wife both claim HRA?

Yes, both husband and wife can claim HRA provided the landlord issues two rent receipts or states the proportion of rent paid individually by husband and wife.

Can you claim HRA if you live in your house?

No, you cannot claim HRA benefit in this case.

Can HRA be claimed if rent is paid for 2 houses?

It is possible if you have lived in two different houses at different points of time in the financial year.

Can I claim HRA on two houses if I and my family are living in different cities and rent is paid for both?

According to sec 10(13A) of The Income Tax Act 1961, you can claim HRA deduction only for the house where you are living and not for any other rented accommodation.

Get in Touch With us

Register here and Avail the Best Offers!!